Day Trading Tax Reporting

Want to start day trading crypto. Along with your personal tax filing you should file this form for the first year officially trying to avoid necessary taxes.

How To Save U S Taxes For Nonresident Aliens

How To Save U S Taxes For Nonresident Aliens

In effect your losses will be on Schedule D limited to 3000 like everyone else but your day trading expenses will go on Schedule C unlike others classified as investors.

Day trading tax reporting. However if youre married and use separate filing status then its 1500. I have only filed once a year before as a W2 employee. Exchanges like Coinbase make transaction history available for this purpose.

Once you have identified which of the brackets detailed below your trading activity falls into you are required to pay taxes on your generated income by the end of the tax year December 31st. I am interested in day trading crypto using the Crypto markets. For example day-traders who make all their trading transactions within the same day should report transactions as business income.

I am interested in working to get short term gains going but would have to start filing quarterly if there are gains. If youre a trader you will report your gains and losses on form 8949 and Schedule D. The IRS holds you responsible for reporting all income and transactions whether you receive a tax form from a crypto exchange or not.

Traders report their business expenses on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship. Its always best to check with your accountant on that. Sole proprietorship LLC etc.

Therefore you do not have to worry about offsetting any such gains by taking capital. Continue Reading Below People who are not used to these types of. 25000 for pattern day trader designation.

With day trading your gains and losses still go on Schedule D but your business expenses such as margin interest computer costs allocatable to the business etc. However late and non-payments can result in serious consequences. What about reporting taxes quarterly.

The securities held for investment must be identified as such in the traders records on the day he or she acquires them for example by holding them in a separate brokerage account. The benefit is that net trading losses can be deducted against other income on an unlimited basis. If your profits are larger than your losses and thats the goal you may need to pay quarterly.

On the other hand if youre buying and selling only with a view to making a profit and you conduct yourself similarly to a trader or dealer in securities your transactions should be reported as business income. Day trading tax rules in Canada are on the whole relatively fair. You can deduct only 3000 in net capital losses each year.

For investors this expense is deductible only against investment. A Schedule C with different tax forms for trading gains and losses. The IRS looks at three things to determine if you are a day trader.

Go on Schedule C. Third you must day trade on a regular and continual basis. Commissions and other costs of acquiring or disposing of securities arent deductible but must be used to figure gain or loss upon disposition of the securities.

Report a Security Issue. In order to get the tax break offered to day traders you will have to notify the IRS ahead of time by making a mark to market selection which includes providing a tax return on your earned income from the previous tax year. As more individuals dabble in day-trading during the coronavirus pandemic some may be surprised by the tax implications next year.

A partnership tax return looks better to the IRS vs. That would mean paying a tax payment every 4 months. Cryptocurrency tax software like CryptoTraderTax was built to automate the entire crypto tax reporting process.

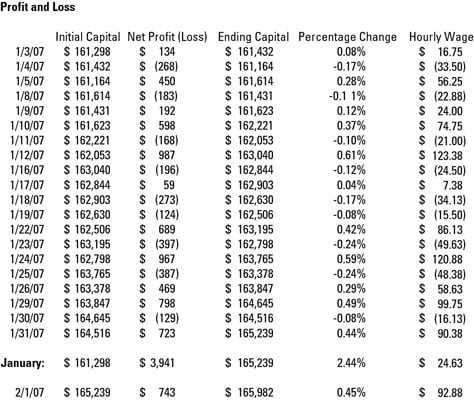

So how to report taxes on day trading. Second when the IRS looks at your tax return all or most of your income must come from day trading to meet the substantial activity rule. With day trading taxes we may have to pay taxes quarterly.

For tax year 2018 if you are in the 10 or 12 tax bracket you are not liable for any taxes on capital gains. Mark-to-market accounting is a method in which you report gains and losses as if you sold everything on the last day of the year which means you mark the securities held to the end-of-the-year market value. First you must look to profit from daily price movements in the security.

Active trading professionals will need to understand the uses of a few tax forms depending on what kind of business model you have established ie. This is done at the end of each tax year. Taxes are a complicated hoop for day traders to pass through when reporting profits and.

Any investment interest expense related to your trading business is 100 deductible as a normal business expense on Schedule C. By integrating directly with leading exchanges wallets blockchains and DeFi protocols the CryptoTraderTax engine is able to auto-generate all of your necessary tax reports based on your historical data.

How Do Taxes Work As A Day Trader Day Trading Taxes Explained Youtube

How Do Taxes Work As A Day Trader Day Trading Taxes Explained Youtube

Day Traders Can Use Regulated Crypto Futures To Save Big On Taxes

Day Traders Can Use Regulated Crypto Futures To Save Big On Taxes

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

How To Become Eligible For Trader Tax Status Benefits

How To Become Eligible For Trader Tax Status Benefits

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

Cryptocurrency Tax Guide 2020 Filing And Paying Taxes On Cryptos Bitira

Cryptocurrency Tax Guide 2020 Filing And Paying Taxes On Cryptos Bitira

How To File Robinhood 1099 Taxes

How To File Robinhood 1099 Taxes

No Need For Scrip Wise Reporting Of Day Trading And Short Term Capital Gains In Itr Cbdt

No Need For Scrip Wise Reporting Of Day Trading And Short Term Capital Gains In Itr Cbdt

How To Qualify For Trader Tax Status For Huge Savings

How To Qualify For Trader Tax Status For Huge Savings

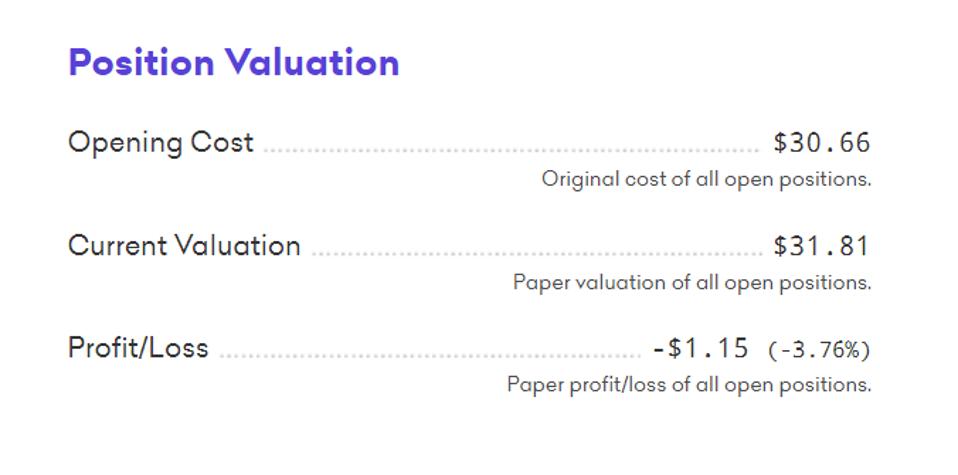

How To Keep Track Of Your Day Trading Gains And Losses Dummies

How To Keep Track Of Your Day Trading Gains And Losses Dummies

Day Trading Taxes 2020 How To Maximize Your Profits Warrior Trading

Day Trading Taxes 2020 How To Maximize Your Profits Warrior Trading

Day Trading Taxes Explained Youtube

Day Trading Taxes Explained Youtube

The Best Tools And Software For Day Trading Warrior Trading

The Best Tools And Software For Day Trading Warrior Trading

Irs Wash Sale Rule Guide For Active Traders

How To Pay Taxes On Payouts Made From Online Forex Trading

/GettyImages-914675658-ef28de13799f4a8582e3c46be4e1668a.jpg) How To Use Tax Lots To Minimize What You Owe

How To Use Tax Lots To Minimize What You Owe

Day Trading Taxes Complete Tax Guide For Traders Benzinga

Day Trading Taxes Complete Tax Guide For Traders Benzinga

:max_bytes(150000):strip_icc()/GettyImages-1126146268-c3dc871a24ae4d56857aa2e5dba217ec.jpg)

Post a Comment for "Day Trading Tax Reporting"