What Is A Day Trading Buying Power Call

The funds must stay in the account for at least two business days before your account is returned to good standing. Until the day trade maintenance call is met pattern day traders must.

To Be Able To Invest In An Options Straddle You Want To Simultaneously Purchase The Same Amount Of Call And Put Option Put Option Option Strategies Call Option

To Be Able To Invest In An Options Straddle You Want To Simultaneously Purchase The Same Amount Of Call And Put Option Put Option Option Strategies Call Option

If your brokerage account has been designated as a pattern day trading account you benefit from a higher level of potential margin loan leverage often referred to as buying power.

What is a day trading buying power call. In general a customer who is not in aggregation and who comes into the day with no overnight positions has a much smaller likelihood of generating a DT call. The buying power for a pattern day trader is four times the excess of the maintenance margin as of the closing of business of the previous day say an account has 35000 after the previous days. While in a day trade call your account will be restricted to day trading buying power of only 2 times maintenance margin excess.

When your equity is at least 25000 you can day trade up to your day-trading buying power DTBP. While this is the industry standard some brokers will reduce the day trading leverage that is available based their risk tolerance. For example if you place opening trades that exceed your accounts day trade buying power and close those trades on the same day you will incur a day trade call.

Your day trade buying power DTBP figure at the start of day is the maximum amount available to use for making round-trip day trades for that day. The power call is equal to 25. Your Day Trading Buying Power is equal to the excess maintenance margin that is available in your account multiplied by four.

You then have 5 business days to meet a call in an unrestricted account by depositing cash or marginable securities in the account. And your margin buying power. Day trading is a different animal altogether.

A day trade call is generated whenever you place opening trades that exceed your accounts day trade buying power and then close those positions on the same day. For example if you have 25000 of capital in your account your Day Trading Buying Power is equal to 100000. Futu calculates the day-trading margin requirement based on the customers total trading commitment during the day so you can trade up to twice your maintenance margin excess as of the close of previous trading day.

A DT Call can ONLY be met by depositing funds in the full amount of the call. Day trading applies to virtually all securities--stocks bonds ETFs and even options calls and puts. Day Trade Maintenance Call see Day Trade Margin Requirements here If Day Trading Buying Power DTBP is exceeded intraday a day trade maintenance call will be issued the following business day.

The broker is also liable to issue a day trade buying power call according to the FINRA Financial Industry Regulation Authority day trading margin requirements. This refers to the amount of capital that is available to place trades on a specific day. Day trade maintenance calls are due in five business days.

If your account exceeds your day trade buying power at any point during the day your account will be issued a day trade buying power call which will result in your day trading buying power being immediately restricted to two times the SRO calculations for the next five business days. Liquidating stocks cannot meet a DT Call. Day Trading Buying Power This is where the train begins to come off the rails a little.

Day Trade Buying Power Call DTBP What triggers the call. In the States and most world exchanges you are allowed 4 to 1 buying power for your trading activity. Until the margin call is met your day-trading account will be restricted to day-trading buying power of only two times maintenance margin excess based on your daily total trading commitment.

This is also called a round trip Security position. Buying power equals the total cash held in the brokerage account plus all available margin. The number one cause of DT calls is day trading on the proceeds from closing overnight positions.

If you plan to day trade disable the money market sweep. A Day Trade Call is generated whenever opening trades exceed the accounts Day Trade Buying. A DT Call occurs when your day trading exceeds the day trading buying power issued on a given day.

Buying power is the money an investor has available to purchase securities. The aggregate method using the total of all day trades will be used. If an account has an outstanding Day Trading Margin Call Day Trading Buying Power will be reduced to two 2 times the NYSE excess and the time and tick calculation method cannot be used while a Day Trading margin call is outstanding.

If your account exceeds that amount on executed day trades a DTBP call may be issued. A standard margin account. If the day-trading margin call is not met by the fifth business day the account will be further restricted to trading only on a cash available basis for 90 days or until the call is met.

What Is A Margin Call Margin Call Formula Example

What Is A Margin Call Margin Call Formula Example

The Difference Between Selling A Call Buying A Put In 2020 Option Trading Options Trading Strategies Option Strategies

The Difference Between Selling A Call Buying A Put In 2020 Option Trading Options Trading Strategies Option Strategies

What Is Day Trading Buying Power Warrior Trading

What Is Day Trading Buying Power Warrior Trading

Margin Requirements Initial Maintenance Margin Requirements

Margin Requirements Initial Maintenance Margin Requirements

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Td Ameritrade Pattern Day Trading Rules Pdt For 2021

Instant Buying Power And Pattern Day Trading

Instant Buying Power And Pattern Day Trading

So What Is So Special About Debit Spreads Options That Make Them A Superior Option Trading S Options Trading Strategies Stock Options Trading Option Strategies

So What Is So Special About Debit Spreads Options That Make Them A Superior Option Trading S Options Trading Strategies Stock Options Trading Option Strategies

Market Cycle Psychology Psychological Stages In Trading Psychology Trading Stock Market Stock Options Trading Trading Quotes

Market Cycle Psychology Psychological Stages In Trading Psychology Trading Stock Market Stock Options Trading Trading Quotes

Margin Trade Funding Enhance Your Buying Power Get Upto 4x Leverage Online Trading Online Share Trading Online Stock Trading

Margin Trade Funding Enhance Your Buying Power Get Upto 4x Leverage Online Trading Online Share Trading Online Stock Trading

How To Use Forex Margin Level To Avoid A Margin Call Forex Quarters Forex Investing Money How To Get Rich

How To Use Forex Margin Level To Avoid A Margin Call Forex Quarters Forex Investing Money How To Get Rich

Do You Know What Makes The Iron Condor Trading Strategy Preferred By Traders Look At The Article To Iron Condor Options Trading Strategies Trading Strategies

Do You Know What Makes The Iron Condor Trading Strategy Preferred By Traders Look At The Article To Iron Condor Options Trading Strategies Trading Strategies

Trades Are Performed Directly Into Your Broker S Trading Account It Is Very Easy To Use So It Doesn T Matter If You Are Forex Trading Forex Training Trading

Trades Are Performed Directly Into Your Broker S Trading Account It Is Very Easy To Use So It Doesn T Matter If You Are Forex Trading Forex Training Trading

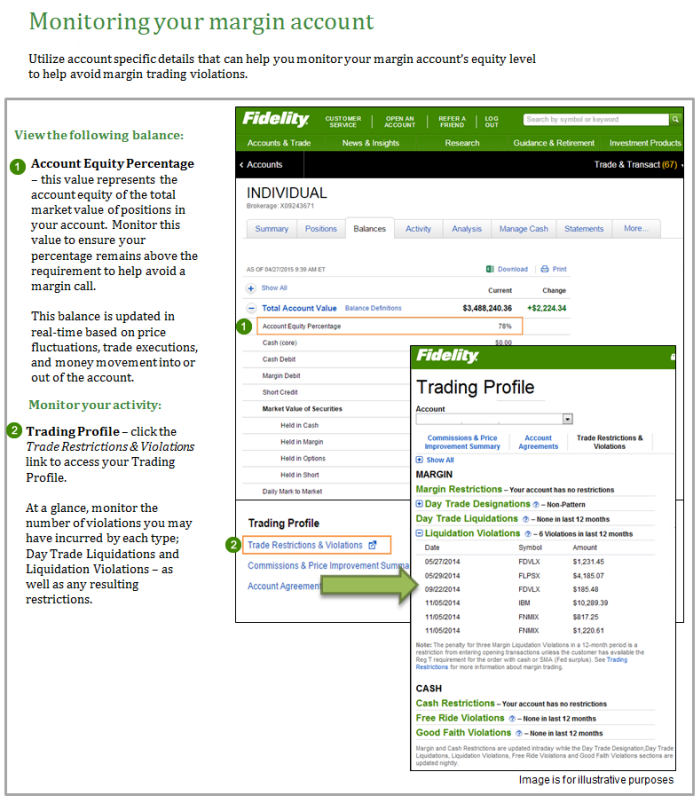

Margin Account Trading Violations Fidelity

Margin Account Trading Violations Fidelity

Forex Trading What Are Pips And Margin In Forex Market You Can Get More Details By Clicking On The Image

Forex Trading What Are Pips And Margin In Forex Market You Can Get More Details By Clicking On The Image

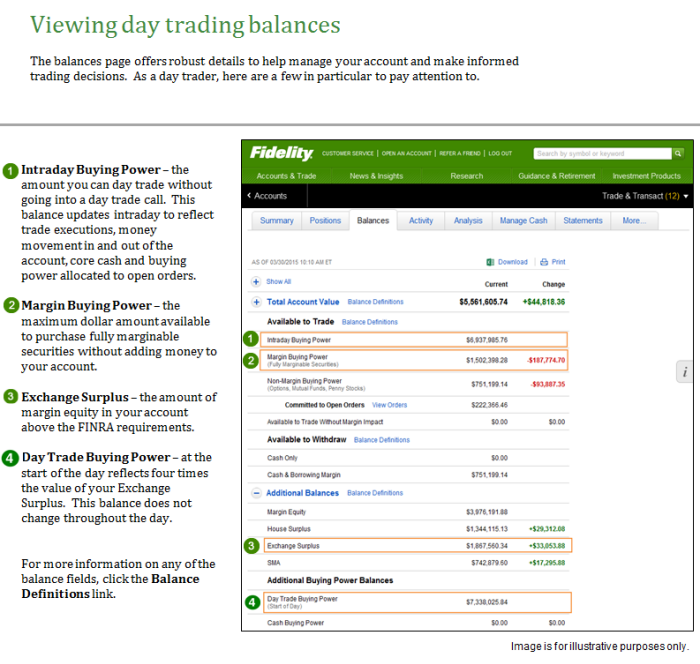

Beyond Margin Basics Ways Investors Traders May Ap Ticker Tape

Beyond Margin Basics Ways Investors Traders May Ap Ticker Tape

Can You Trade Stock Options In An Ira Options Trading Strategies Stock Options Trading Covered Calls

Can You Trade Stock Options In An Ira Options Trading Strategies Stock Options Trading Covered Calls

Post a Comment for "What Is A Day Trading Buying Power Call"