Day Trading Llc Vs S Corp

I would probably use the LLC for day trading if I used any entity. Before you start your own business you have to decide by law the legal formation you want for your business.

Llc Vs S Corp The Amazing Tax Benefits Of Having A Business

Llc Vs S Corp The Amazing Tax Benefits Of Having A Business

The odds of being selected for IRS audit in the first place is.

Day trading llc vs s corp. If you prefer a flexible management style go with an LLC. A C corporation is a corporation in which the owners or shareholders are taxed separately from the entity. Over the past 20 years weve grown significant capital developed proven technology and maintained an appetite for diversified trading strategies.

By placing your trading activities in a separate entity such as a C-Corp an S-Corp a multi-member LLC or a Family Partnership that is dedicated solely to securities trading you can effectively eliminate most of the extracurricular activity challenges the IRS might bring up. The S-Corp is more tightly structured than the LLC which for many purposes makes it particularly less desirable than an LLC when there is more than one owner. Generally speaking there is no home office deduction available when using an s-corporation.

For more information please contact the Department of Business Services Limited Liability Division at 217-524-8008 ext. An S-Corporation is a tax free entity for federal tax purposes and some states have some taxes assessed and annual reporting fees. Business expense treatment saves traders more than 5000 per year in taxes vs.

I do not recommend an LLC or Limited Liability company for your day trading business. With an S-Corporation you have similar right without the double taxation of C-corporations. You will want to see a CPA for tax implications and consult with an attorney to set up your S-Corporation correctly and legally.

Using a dual entity solution where a trading partnership and S-Corp management company are used to avoid the states 15 franchise tax on S-Corps. Each individuals circumstances are unique and may be interpreted differently. Assume an unmarried trader age 51 has S-Corp net trading income of approximately 225000 and individual taxable income of 200000.

How taxes are treated Both S corporations and LLCs are pass-through entities which means profits pass directly from the business to the owners as personal income. That puts her in a 32 marginal federal tax. C corporations the most prevalent of corporations are also subject to corporate income.

This creates a tax partnership and the S corporation problems involving the new investor or employee have been managed. The old corporation then converts into an LLC in some states the conversion occurs by way of merger of the Q-sub into the LLC. 7736 or complete the Business Services contact form.

As a business structure if youre more concerned with employment tax benefits. As a trader there is no need to pay a salary. A C-Corp in California would lead to much higher federal and state taxes vs.

Instead you can trade under an LLC and take a non-taxable distribution. Learn more about how weve grown from a small team in Dublin to a global competitor in the trading industry. In my last blog dated May 8 Business Structure Dictates Tax Treatment For Professional Traders I recommended electing S-Corportation tax treatment for a management company or trading business.

We generally recommend that day traders conduct their active trading business in a legal entity usually an LLC. Cash is not accepted for filings with the Secretary of States office. Whether you operate an LLC or S-corp you assume personal liability for all business debts and obligations.

If youre ready to elevate your day trading business with legal entity formation Traders Accounting is here to help you through the process. Which exists to be the general partner or managing member of several limited liability companies. If you are a day trader and trade frequently then this requirement can be a real burden.

Is the protection you have for your personal assets from business creditors. Using an S corporation a partnership or a sole proprietorship to trade stock will accomplish the pass through OR you could use an LLC to trade and have the LLC taxed as a sole proprietorship disregarded entity partnership if more than one person or an S corporation. One of the biggest advantages of operating an LLC or S-corp.

In short if the business fails you stand to lose a lot. The S-Corp shows all activity whereas a Schedule C only shows business expenses with trading gains reported on other tax forms and that looks like a losing business to the IRS. Because of the uniqueness of each individual there is no one sure fire strategy to make an active trader immune to the effects of murky trading tax law.

The investor or employee is then admitted into the LLC which was the old corporation. By contrast if you are a trader your trading activities are classified as a business. It is a smart idea to incorporate your day trading into an S-Corporation.

Make checks payable to the Illinois Secretary of State. You can account for these as a sole proprietor an S-corp an LLC or another type of business entity that may be appropriate for your situation. The additional tax youll incur as an S-Corp is 153 of anything that you pay out.

Llc Vs Corporation Vs Sole Proprietorship Llc Business Business Basics Business Entrepreneurship

Llc Vs Corporation Vs Sole Proprietorship Llc Business Business Basics Business Entrepreneurship

When To Turn Your Blog Into A Formal Business S C Corp Llc Business Checklist Business Blog

When To Turn Your Blog Into A Formal Business S C Corp Llc Business Checklist Business Blog

Trading Entities For Day Traders

Trading Entities For Day Traders

5 Types Of Business Structures Business Structure Business Online Business Launch

5 Types Of Business Structures Business Structure Business Online Business Launch

C Corporation Vs S Corporation Vs Llc Business Tax S Corporation C Corporation

C Corporation Vs S Corporation Vs Llc Business Tax S Corporation C Corporation

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Proprietorship Sole Proprietorship Sole Llc

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Proprietorship Sole Proprietorship Sole Llc

Can I Convert My Llc To An S Corp When Filing My Tax Return Turbotax Tax Tips Videos

Can I Convert My Llc To An S Corp When Filing My Tax Return Turbotax Tax Tips Videos

Should Your Business Be An Llc Or An S Corporation Inc Com

Should Your Business Be An Llc Or An S Corporation Inc Com

Autopzionibinarie A Un European Headquarters In Belgium Forex Trading Courses Online Trading

Autopzionibinarie A Un European Headquarters In Belgium Forex Trading Courses Online Trading

S C Corp Or Llc For Your Blog Comparison Chart Business Checklist Business Blog

S C Corp Or Llc For Your Blog Comparison Chart Business Checklist Business Blog

When To Switch From Llc To S Corp Online Taxman

When To Switch From Llc To S Corp Online Taxman

201 Llc Vs S Corp 3 Drawbacks Of An S Corporation Costs And Problems Youtube Llc Business S Corporation Business Finance

201 Llc Vs S Corp 3 Drawbacks Of An S Corporation Costs And Problems Youtube Llc Business S Corporation Business Finance

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment Income Tax S Corporation

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment Income Tax S Corporation

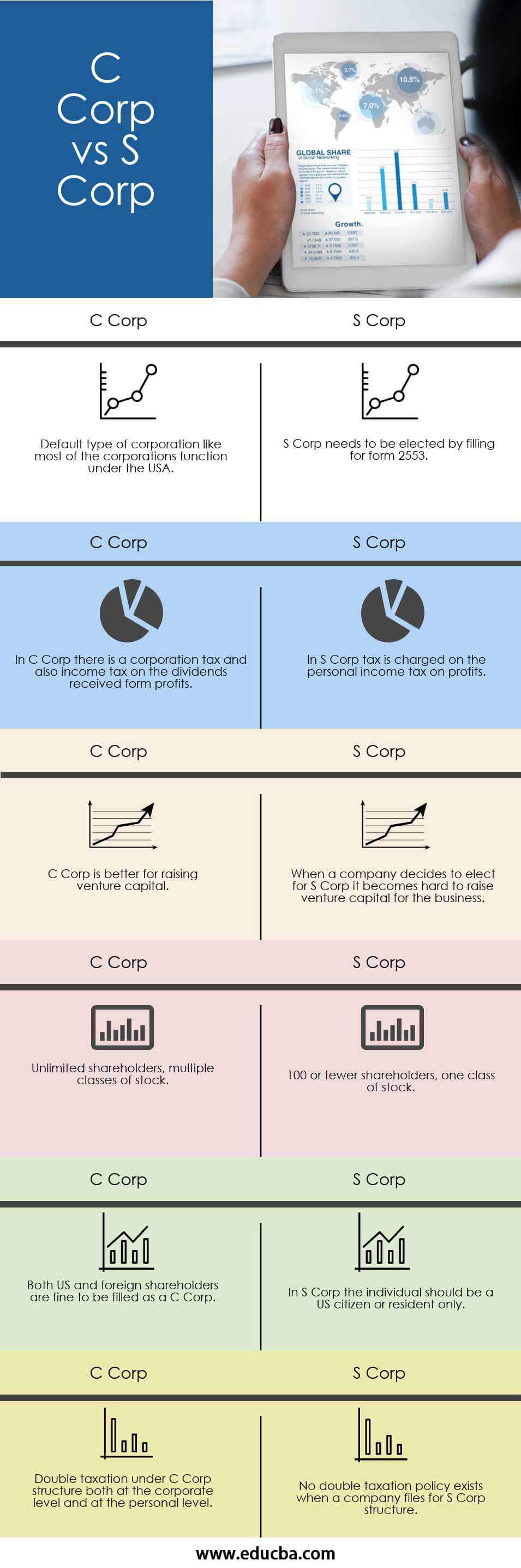

C Corp Vs S Corp Top 6 Best Differences With Infographics

C Corp Vs S Corp Top 6 Best Differences With Infographics

S Corp Vs Llc For Real Estate Investing Which Is Better Mentorship Monday Youtube

S Corp Vs Llc For Real Estate Investing Which Is Better Mentorship Monday Youtube

S Corporations And Reasonable Officer Salaries S Corporation Small Business Owner Business Books

S Corporations And Reasonable Officer Salaries S Corporation Small Business Owner Business Books

Llc Vs S Corp The Amazing Tax Benefits Of Having A Business

Llc Vs S Corp The Amazing Tax Benefits Of Having A Business

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Proprietorship Sole Proprietorship Sole Llc

Llc Vs Sole Proprietorship Here We Provide You With The Top 7 Differences Between Llc Vs Sole Proprietorship Sole Proprietorship Sole Llc

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

Post a Comment for "Day Trading Llc Vs S Corp"